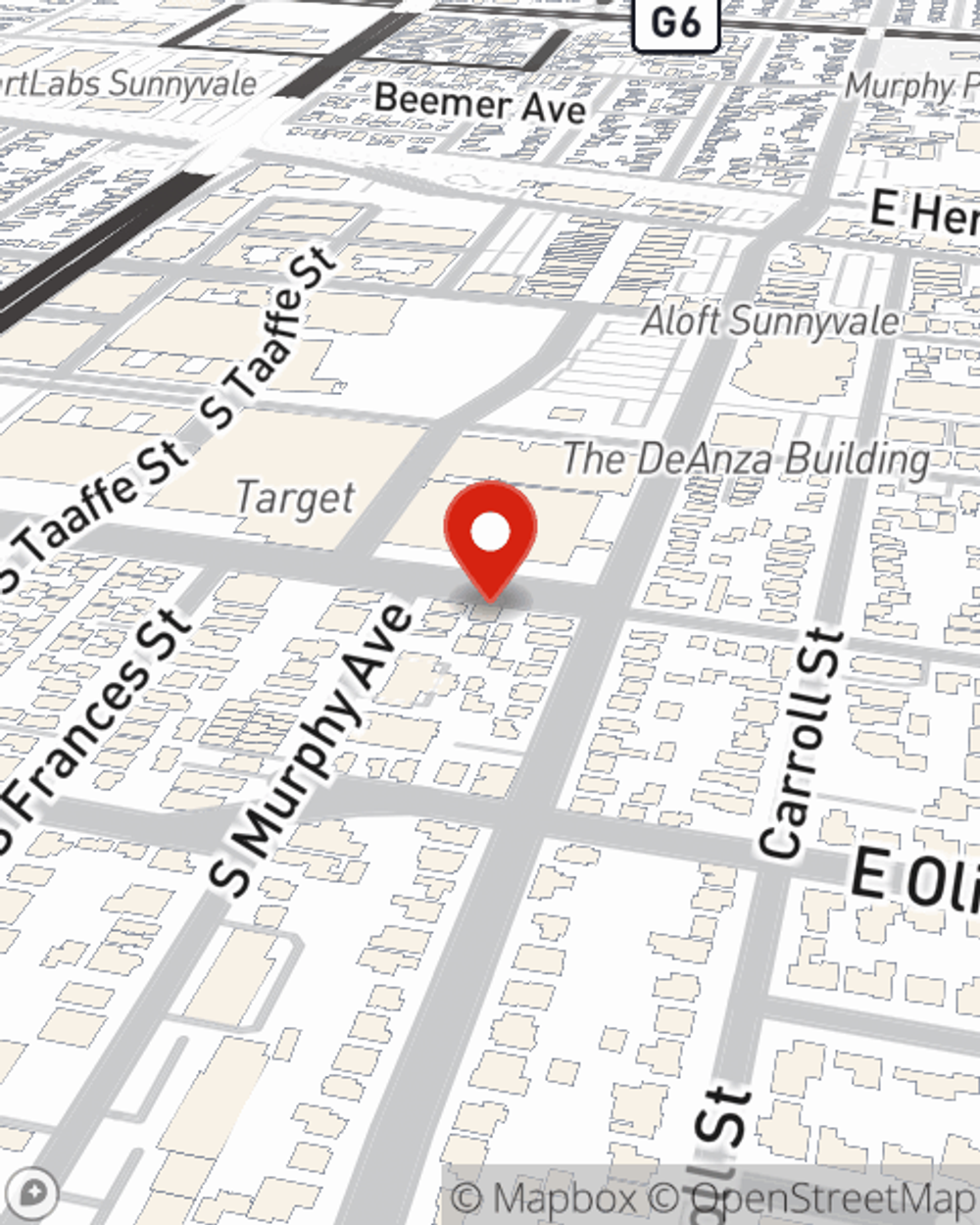

Renters Insurance in and around Sunnyvale

Your renters insurance search is over, Sunnyvale

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

- Sunnyvale, CA

- Santa Clara, CA

- Cupertino, CA

- Mountain View, CA

- San Jose, CA

- Los Altos, CA

- Palo Alto, CA

- Los Gatos, CA

- Santa Clara County

- California, US

- Monterey County, CA

- Alameda, County, CA

- Contra Costa County

- Yolo County, CA

- San Mateo County, CA

- Sonoma County, CA

- San Francisco County

- Los Angeles County

- Orange County, CA

Home Sweet Home Starts With State Farm

Home is home even if you are leasing it. And whether it's a house or a condo, protection for your personal belongings is a good precaution, even if your landlord doesn’t require it.

Your renters insurance search is over, Sunnyvale

Your belongings say p-lease and thank you to renters insurance

State Farm Has Options For Your Renters Insurance Needs

It's likely that your landlord's insurance only covers the structure of the townhome or apartment you're renting. So, if you want to protect your valuables - such as a bicycle, a smartphone or a set of cutlery - renters insurance is what you're looking for. State Farm agent AJ Abdelkhalek is passionate about helping you choose the right policy and protect yourself from the unexpected.

Renters of Sunnyvale, get in touch with AJ Abdelkhalek's office to learn more about your specific options and how you can benefit from State Farm renters insurance.

Have More Questions About Renters Insurance?

Call AJ at (408) 732-4100 or visit our FAQ page.

Simple Insights®

Common rental scams and landlord frauds

Common rental scams and landlord frauds

Rental and landlord scams are more common than you think. Learn ways to tell if a rental is legitimate and how to avoid apartment scams.

Moving? Don't forget to make insurance changes, too

Moving? Don't forget to make insurance changes, too

Before you move, talk with your agent about move insurance and moving your current policies. Read why transferring insurance is so important.

AJ Abdelkhalek

State Farm® Insurance AgentSimple Insights®

Common rental scams and landlord frauds

Common rental scams and landlord frauds

Rental and landlord scams are more common than you think. Learn ways to tell if a rental is legitimate and how to avoid apartment scams.

Moving? Don't forget to make insurance changes, too

Moving? Don't forget to make insurance changes, too

Before you move, talk with your agent about move insurance and moving your current policies. Read why transferring insurance is so important.